By Katie Treuer

In recent years, private credit has stepped in to help fill some of the biggest gaps in our capital markets. Where traditional investors have struggled to provide the adaptability needed to navigate turbulent economic landscapes, private credit has offered bespoke, personalized capital lifelines. This flexibility has proved particularly vital for funding solutions aimed at big, complex challenges like the transition to sustainable infrastructure, where much of the hardship lies in mobilizing and scaling physical assets, commercializing emerging technologies and opening new markets. At Generate, we view credit as an essential piece of the sustainability funding equation, alongside our equity investing in projects and companies. Creative credit strategies are instrumental to solving some of the infrastructure transition’s persistent challenges.

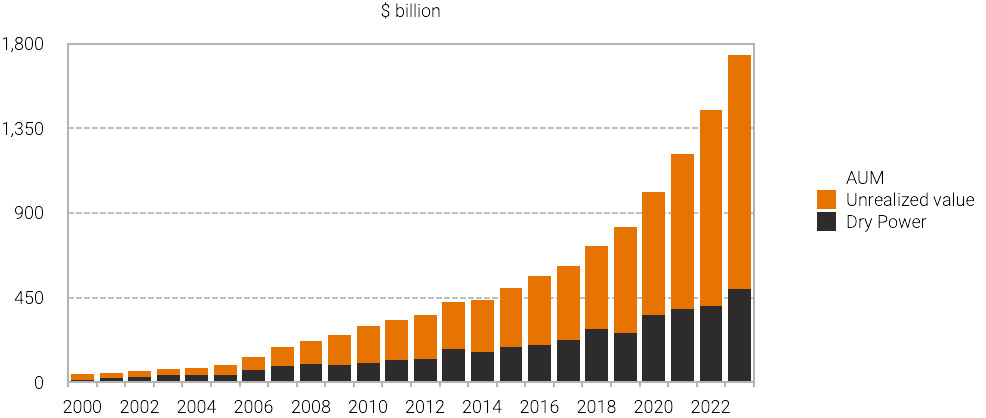

To assess the role credit can play in the infrastructure transition, it’s helpful to understand the driving forces behind private credit’s rising popularity. Until recently private credit was a niche strategy within the debt infrastructure investment landscape, overshadowed by the traditional debt funders such as commercial banks and institutional investors that historically dominated the landscape. This dynamic started to shift during the Covid-19 pandemic, when market volatility caused traditional investors to pull back to preserve liquidity and private credit investors stepped in to fill the gaps. The rising interest rates that followed in 2022 drove even more investors to the private credit space. Banks were focused on selling hung debt from unprofitable loans, and private credit funds emerged to fill the lending void. Additionally, many private equity investors, who had thrived during the prior low-interest rate environment, turned to private credit as a strategy to access and deploy more dry powder to contend with fewer exits. Given these dynamics, private debt funds grew from having $500 billion of assets under management globally in 2015 to $1.7 trillion in 2023 (Figure 1).

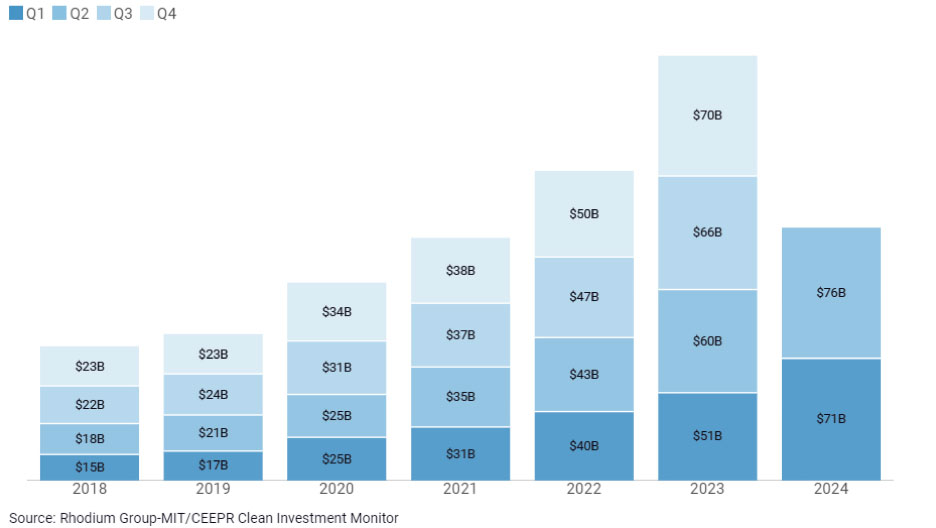

This time period also coincided with a mass mobilization and allocation of capital toward the energy and infrastructure transition. In response to climate change, governments, corporations, technology companies, and financiers have taken significant action in recent years. US climate-focused investments totaled $247 billion in 2023, increasing 216% from $78 billion five years prior (Figure 2).

While private credit’s application towards funding climate and infrastructure projects may have been prompted by external economic factors, it has taken hold for good reason. The transition is at an inflection point, and creative credit strategies have proved to be well-suited for the types of projects that it needs at this juncture – oftentimes better-suited than traditional capital markets.

Many sustainable technologies operate in the overlooked and underserved middle market. These companies often face challenges in securing the capital needed to scale. This is not necessarily due to high risk, but rather project-specific complexities or deal sizes that are too small to attract large investors. Creative credit strategies, alternatively, can accommodate borrowers who need more flexible terms, as is the case with many deals in emerging climate and infrastructure markets. Lenders can design bespoke deals tailored to the specific project dynamics and tap into structured solutions. The private credit model also typically allows borrowers and lenders to develop closer relationships with more deal protections and generally better terms.

Generate has learned these lessons firsthand through our experiences as a private credit lender. For example, utility-scale solar and energy storage financing was bound at the hip to contracted cashflows for years, which increasingly left value on the table. It had become a constraint on the sector’s growth. In 2021, Generate and a handful of fellow investors provided $600 million of corporate capital to help finance the development of Intersect Power’s solar and storage pipeline. The deal provided Intersect Power with financing to scale its business while helping evolve the business and financing model for utility-scale solar and storage market, allowing it to grow. A record 17.8GW of utility-scale solar was installed in the US in 2021, with annual installations rising by almost ten gigawatts to 26.7GWdc only two years later, in 2023 (BloombergNEF).

Also in 2021, Generate executed a roughly $200 million loan facility with a financing partner to fund the purchase, installation and operations of up to 260MWh of energy storage systems from a top-tier supplier. The systems would provide resiliency services to essential service providers in low-income communities in California that have been or are likely to be affected by wildfires. The energy storage market in 2021 was small, with interested commercial banks and institutional investors fewer and far between. It was however poised for rapid growth: flexible capital such as the loan facility helped the market scale from 3.8GW of annual installations in 2021 to a forecast 14GW in 2024 (BloomberNEF), while resulting in attractive realized returns for Generate. Over the past few years, the market has matured significantly with debt and tax equity becoming more common. For example, portfolio company esVolta secured $258 million in project-level financing for three projects in ERCOT, totaling 490 MW / 980 MWh, in July 2024. This followed a $185 million debt facility from Nomura earlier in the year, along with tax equity financing for a project in November 2023.

As we look ahead, the capital need still vastly outpaces the supply of available financing options and bankable projects in critical sectors such as power, mobility and industrial decarbonization. As domestic onshoring takes hold, this capital is required for projects themselves, and for the factories that make the equipment. Private credit cannot solve these issues alone, but it can play a significant role in addressing the infrastructure transition’s greatest challenge.